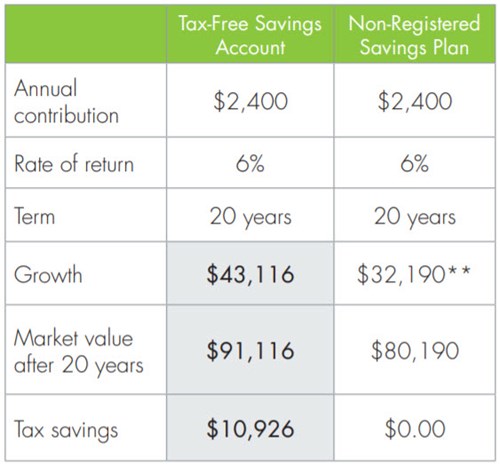

When you invest in a Tax-Free Savings Account (TFSA) you can save more and reach your goals faster. For example, if you were to make a $200 TFSA contribution each month for 20 years, you would have contributed a total of $48,000, while also earning $43,116 in tax-free growth. In comparison to a non-registered account where all investment income is taxable, you would save an additional $10,926 by investing in a TFSA.*

*Calculations assume that the annual tax payable on the non-registered savings plan is paid from the account value of the policy. Combined federal and provincial tax savings based on a $200 monthly contribution for 20 years and a 6% rate of return. For non-registered savings, a 20% average tax rate on investment income is assumed based on 40% interest, 30% dividends and 30% capital gains, using a middle-income earning account holder.

Advantages of a TFSA

Because of the flexibility in a TFSA, most Canadians can benefit from having an account. You can save for anything:

- Home renovations

- A vehicle

- A family trip

- Emergency savings

- Retirement

You can use a TFSA as an alternate source of income during retirement. Individuals who expect they will be in an equal or higher tax bracket when they retire often contribute to a TFSA. Unlike an RRSP, a TFSA does not need to be converted to an income product at age 71, which makes it an ideal option for retirees who are looking for a way to save on a tax-free basis throughout their retirement. Additionally, income from a TFSA does not affect your eligibility to receive:

- Old Age Security (OAS),

- Guaranteed Income Supplement (GIS),

- Goods and services tax (GST) credit, or

- Other income tested benefits and tax credits.

You can withdraw funds from your TFSA in one year and then redeposit the equivalent amount after the following January. For example, if you contributed $2,000 and it grows to $5,000 over time and you decide to withdraw $5,000 in November, you can then increase your allowable contribution room the following January by $5,000. Whatever the amount that you withdraw – whether it is original capital, income or growth – can be put back in at a later time.

The assets in your TFSA are transferable to your spouse upon your death without affecting your spouse’s existing TFSA or contribution allowance. The surviving spouse then has assets that are tax sheltered and those assets will be passed on to their estate or beneficiary, also without being taxed.

If you don’t think your child will pursue a post-secondary education but you want to set aside money for them, a TFSA is good alternative to the Registered Education Savings Plan. What you wouldn’t receive would be the contributions from the government in the form of their Canada Education Savings Grant.

Talk to your financial advisor to see if a TFSA can help you achieve your goals.