Equitable Life Active Balanced segregated funds are managed in-house by the Equitable Asset Management Group (EAMG). We offer three portfolios designed for a full range of investors’ preferences that span the risk spectrum. Each portfolio is constructed using the same top-down approach, and is adjusted according to the intended portfolio risk tolerance for each fund. All Active Balanced portfolios are constructed using Exchange Traded Funds (ETFs).

Exchange traded funds are investment vehicles that seek to replicate the performance of broad based indices, sectors and other specific investment strategies. While ETFs have been used for years in the Canadian market, they’re just beginning to take hold with professional and institutional investors alike.

Key benefits of using ETFs include:

- increased transparency,

- improved liquidity,

- lower costs, and

- reduced relative performance risk.

Active Balanced Portfolios and ETFs

Our top-down style of investing combined with ETFs represents an ideal pairing of active investment strategies at work with passive investment products. Our goal is to be in the right markets at the right time.

Asset class investment ranges

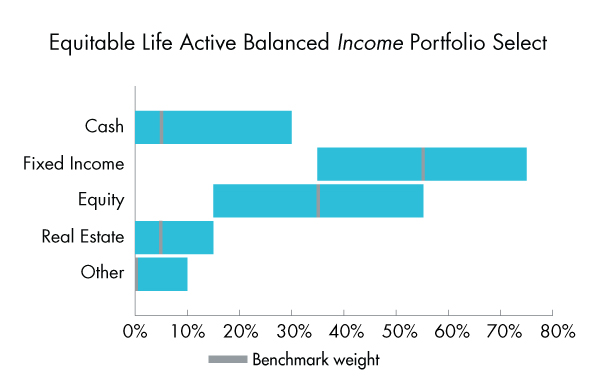

Equitable Life Active Balanced Income Fund

Risk tolerance: Low-to-medium

The “Income Fund” offers the highest exposure to fixed income and the least amount of exposure to equities. This fund is appropriate for investors with lower tolerances for volatility.

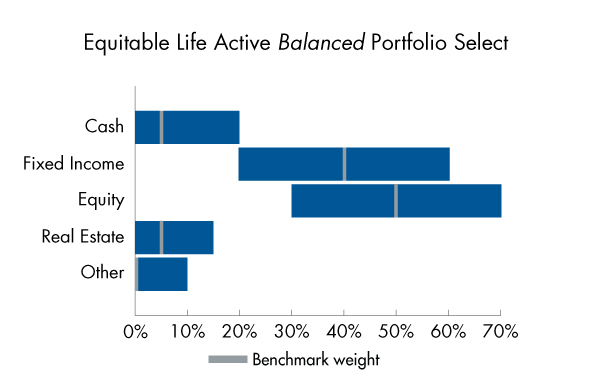

Equitable Life Active Balanced Fund

Risk tolerance: Low-to-medium

The “Balanced Fund” offers a moderated mix between equities and fixed income. This fund is ideal for investors who seek a mix between growth and income.

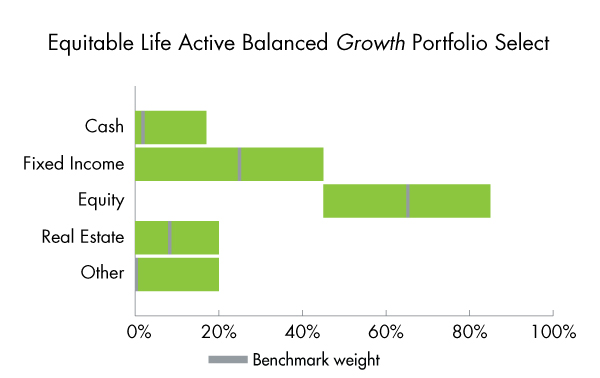

Equitable Life Active Balanced Growth Fund

Risk tolerance: Low-to-medium

The “Growth Fund” offers the highest exposure to equities and the least amount of exposure to fixed income. This fund is appropriate for investors with higher tolerances to volatility.

Gamme de placements associés aux catégories d’actif