Term Insurance

Temporary, affordable protection.

Figure 1 See why Lin chose Term Insurance to protect what she's worked hard to build.

We know that sometimes, while life insurance for you, your family, or your business may be top of mind, it also has to be affordable. With term insurance, you get guaranteed protection for 10, 20 or 30 years with premiums that work within your budget.

- Mortgage protection

- Income replacement

- Funding education

- Paying loans and expenses

- Business expenses

Term Insurance Plans

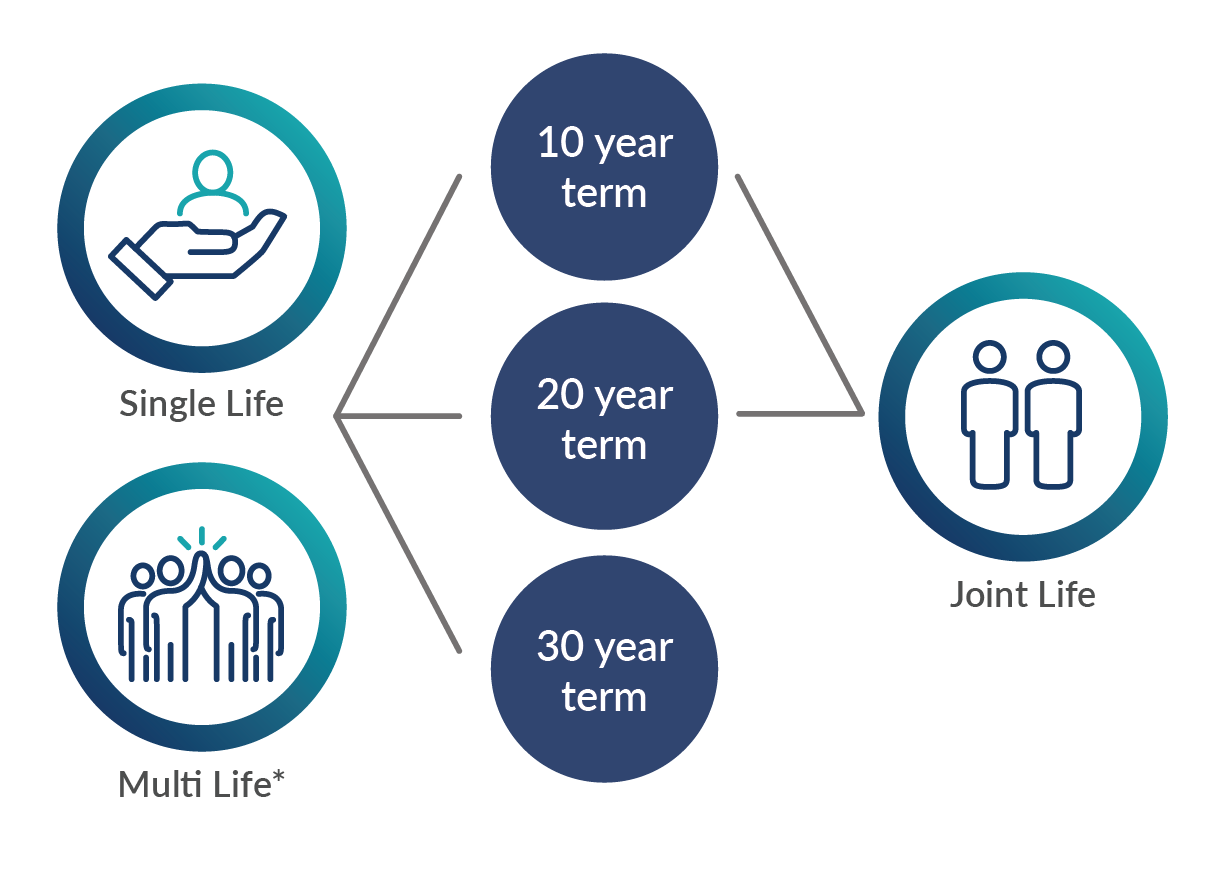

With Term Insurance through Equitable, you get to choose what kinds of benefits you want to add to your plan, who should be insured, as well as how long the plan should last for. When the term ends, your insurance will renew automatically for a higher premium or you can choose to terminate it. You can also switch your term insurance to permanent protection.

*Not available for business policies

*Not available for business policies

Bundle with EquiLiving Critical Illness to help protect your total life and health needs in one simple policy.

Mortgage Protection

Is your mortgage insurance protecting you… or is it protecting your bank? We can help you find the perfect mortgage insurance that puts your needs first.

Learn how Equitable term insurance can protect your mortgage.

Want to know more?

View our term insurance playbook

Speak to your advisor or wholesaler today.

Sample policy pages

Why Equitable?

Our mutuality sets us apart from the rest. We strive to provide our policyholders with excellent, personalized service, security, and wellbeing.

Learn more