Investment philosophy

At Equitable, we believe superior risk-adjusted returns are generated when specialized investment expertise is combined with a comprehensive framework. Since asset class selection is a key component of portfolio returns, our team tactically manages across the asset class spectrum to gain exposure to optimal risk-adjusted opportunities based on economic conditions and underlying fundamental drivers.

Investment strategy

Our investment strategy follows a top-down approach, setting strategic asset allocations based on the current state of the macro-economic cycle. By focusing on the “the big picture” our team manages risk while targeting long-term outperformance. We also make tactical investment decisions, dynamically shifting exposures across and within asset classes based on market internals. Leveraging fundamental and technical analysis, our team strives to identify emerging trends before they are priced in.

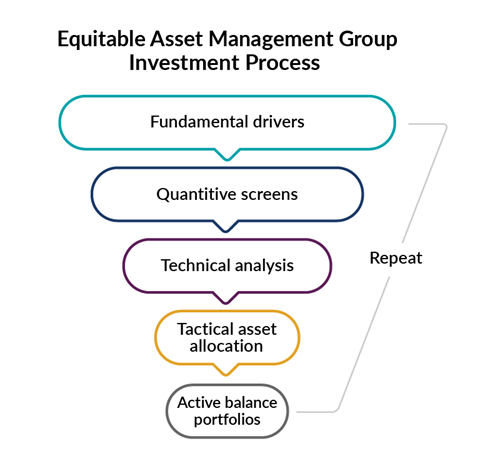

Investment process

Our investment process is systematic and repeatable, overlaying disciplined macroeconomic and fundamental analysis with standardized expected risk and return calculations. As a team of asset-class specialists, we leverage collaborative research to construct portfolios that stand to capitalize on economic and market conditions.

Understanding fundamental drivers of the economy and markets

Our investment process begins with understanding the fundamentals that drive asset class performance over the long-term. For a holistic analysis, we consider factors that include, but are not limited to:

- Economic growth trends and components

- Inflation trends and forecasts

- Monetary and fiscal policy actions

- Labour market dynamics

- Long-term trends such as demographics

Along with our top-down assessment, our fundamental framework includes company-level analysis such as evaluations of financial health and credit worthiness, corporate earnings trends and industry developments.

Quantitative screening of markets

Quantitative analysis enables our team to assess opportunities in the market based on the forecasted reward potential relative to its risk profile. Applying a quantitative approach ensures portfolio exposures align with overall risk-budgets and helps to mitigate the risk of behavioural biases in decision-making.

Applying technical analysis of market dynamics and trends

Technical analysis provides an additional layer of market interpretation that uses shorter-term charting techniques, breadth analysis and other market indicators to gain insight on market performance and direction.

Learn about Equitable funds

Explore the benefits of choosing Equitable