Instead of trying to time the markets, use dollar cost averaging as a simple strategy that helps you build your investment portfolio while averaging out the cost of your purchases. It helps take the guess work out of investing.

How does dollar cost averaging work?

You invest the same amount on a regular basis. Since market prices fluctuate, you will purchase more units when markets are low and buy less units when markets are high. Dollar cost averaging usually lowers the average cost of your investments over time. Think of it as paying a bill—pay yourself to invest. Set up a Pre-Authorized Contribution (or PAC) and have Equitable automatically transfer a pre-set amount of money from your bank account into any of our Equitable investments. You determine how much you want to invest and how often. Once you start, investments are made regularly, so you don’t have to worry about it.

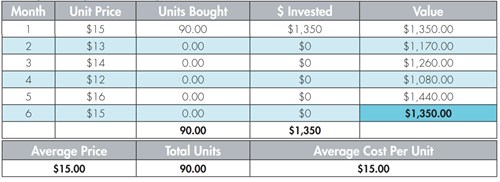

Here’s an example for if you started investing regularly:

But if you only did a lump sum investment:

Dollar cost averaging can lower your average price and increase the number of units you can purchase. Despite the “market volatility” the investment in the example gained $92.87 due to dollar cost averaging. You can use this market volatility to your advantage.

Why dollar cost averaging makes sense:

- No guessing when to “get into the market” or time the market

- Emotion and stress are eliminated from your investing strategy

- You don’t have to invest large amounts

- Helps you maintain consistency in your long-term financial plans