Let’s face it, saving money is hard. Finding money to save is even harder. So let’s figure out how to get what money we do have working for us!

We all know a Retirement Savings Plan (RSP) is a great way to save for retirement. When we make an RSP contribution we receive an immediate tax refund. But instead of spending that refund, consider using it to fund your Tax-Free Savings Account (TFSA).

Not the first idea that pops into your head, I get it, but investing your tax refund can help you build an emergency fund, money for a new car or whatever other short-term goals you’re planning.

A TFSA can also be a secondary retirement savings solutions down the road. Withdrawals from a TFSA are not reported as income and do not affect your eligibility for income-tested government benefits. Benefits like Old Age Security, Guaranteed Income Supplement or the Goods and Services Tax/Harmonized Sales Tax credit.

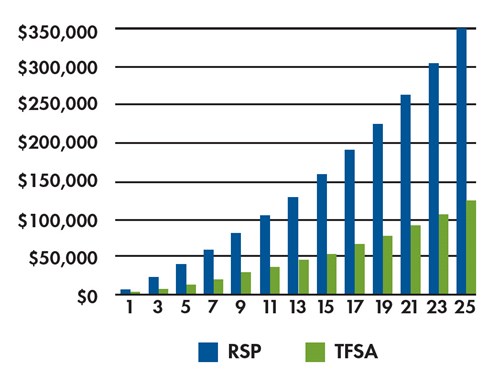

Let’s look at the possibilities.

A $7,000.00 RSP contribution could make a $2,450.00 tax refund. If that refund is invested in a TFSA, after 25 years, it would be worth $122,778.00. Not a bad chunk of change for money you didn’t know you had.

- RSP: $350,794 (withdrawals are taxable)

- TFSA: $122,778 (withdrawals are not taxable)

Illustration based on a 35% marginal tax rate and a 5% annual rate of return.